What will your

legacy be?

We are an impact-driven global nonprofit and with your help together we can change the world.

Ways to Give

There are many ways to give to the National Geographic Society. Click through the tabs below to see details on the options.

By including the National Geographic Society in your will or trust you can help protect and preserve wildlife, oceans, and cultural treasures for future generations. Gifts through wills and living trusts are simple to arrange and may be changed at any time. A provision or amendment prepared by your attorney at the time you make or update your will is all that is necessary.

Making a gift to the National Geographic Society in your will or trust allows you to:

- Retain control of your assets during your lifetime

- Provide for loved ones while supporting the work of exploration, science, and education

- Designate your gift to benefit your favorite National Geographic Society program

- Make a gift in honor or memory of someone special

To make your bequest to the National Geographic Society, please use the following language:

TO THE NATIONAL GEOGRAPHIC SOCIETY IN WASHINGTON, D.C., FEDERAL TAX ID #53-0193519, I HEREBY GIVE $______ (OR _______%) OF MY ESTATE.

CONTACT US FOR MORE INFORMATION

Need a will? We believe everyone should have access to estate planning tools. That’s why we are offering this free resource to our supporters. Get started today!

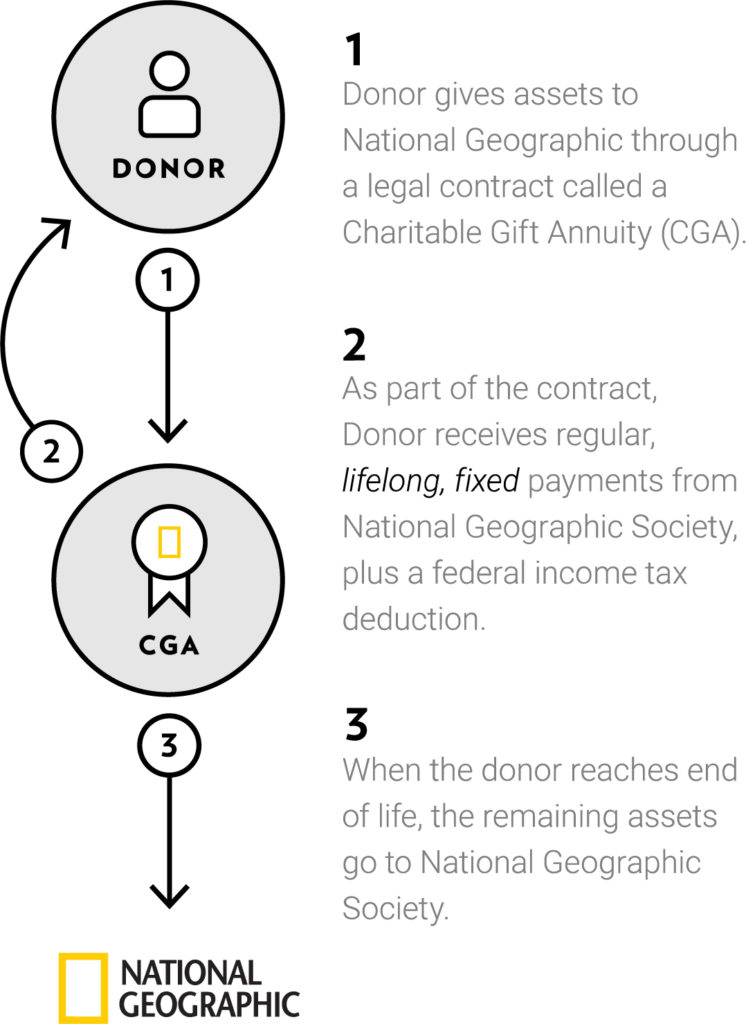

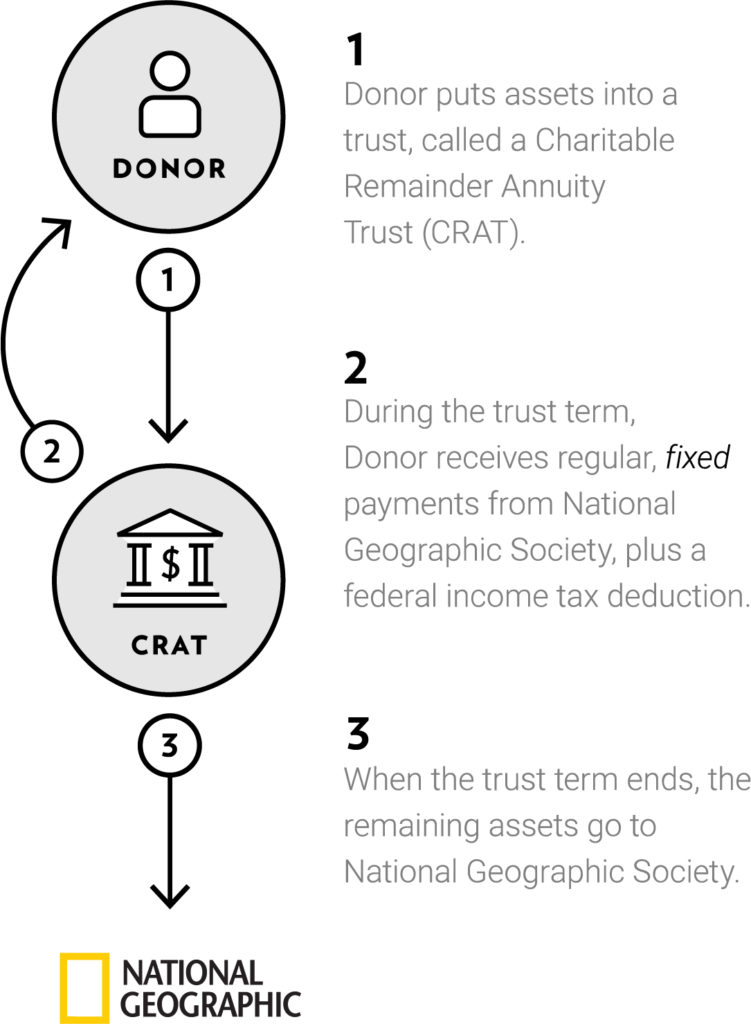

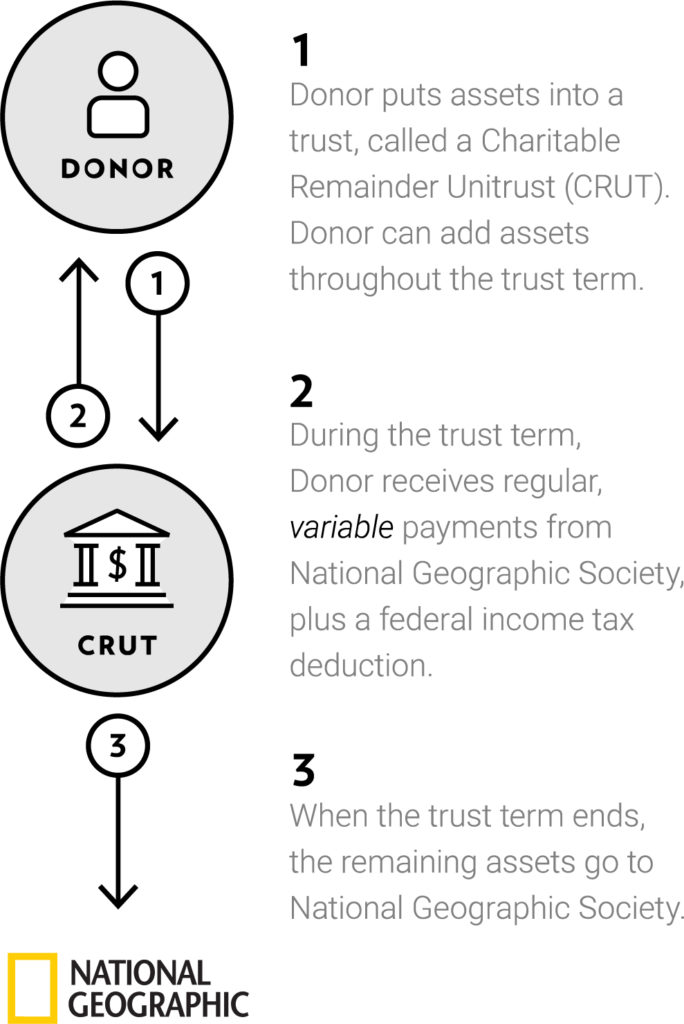

You can establish a Charitable Gift Annuity (CGA) with the National Geographic Society for you and/or another person such as beneficiaries such as family or friends to receive secure, regular payments for the duration of your life or a pre-set term. You can also set up a Charitable Remainder Annuity Trust (CRAT), or Charitable Remainder Unitrust (CRUT) to receive similar payments for one or two beneficiaries.

How It Works

Click on each graphic below to enlarge.

Charitable Gift Annuity (CGA)

The Charitable Gift Annuity is a contract (not a trust), under which the National Geographic Society, in return for a transfer of cash, marketable securities, or other assets, agrees to pay a fixed amount of money to you and/or a loved one for your lifetime. In the year you establish a CGA, you receive a one-time charitable income tax deduction. If your gift is made using long-term appreciated securities, you can eliminate up-front capital gains tax.

Charitable Remainder Annuity Trust (CRAT)

A Charitable Remainder Annuity Trust is an independently invested and managed charitable trust in which you transfer cash, securities, or other property in exchange for a fixed annuity for life or for a term of up to 20 years. The remaining balance passes to the Society when the contract ends or at the end of the beneficiary’s life. Because you cannot add to the principal once the trust is established, your annuity will never change.

Charitable Remainder Unitrust (CRUT)

Like the CRAT, the Charitable Remainder Unitrust is an independently invested and managed charitable trust in which you transfer cash, securities, or other property in exchange for a variable annuity for life or for a term of up to 20 years. The annuity is variable because it is set as a percentage of the value of the trust as determined annually. Since you can add to the trust throughout its term, your annuity may increase or decrease as the trust value changes from year to year. When the trust terminates, the remainder passes to the Society to be used as you have directed.

By naming the National Geographic Society as a beneficiary of your retirement account, life insurance policy, or financial account, you make the most cost-effective gift you can, saving other less-taxed assets for loved ones.

Ways to Give

- Retirement Assets - When you name the National Geographic Society as a beneficiary of your retirement account, you avoid the double taxation of federal estate and income taxes. It’s the most cost-effective gift you can make and allows you to leave other, less heavily taxed assets to your loved ones.

- Life Insurance - Insurance policies that have outlasted their original purpose provide a wonderful way to leave your mark in the world by helping us solve our world’s most pressing challenges. You can make the National Geographic Society a beneficiary on your life insurance policy or you can sign over a fully paid policy.

- Financial Accounts - One of the easiest ways to leave a legacy gift is by a beneficiary designation through stocks, bonds, brokerage accounts, mutual funds, or other bank accounts. Funds from these accounts will pass directly to the beneficiary and do not require a will. These investments will help us protect the wonder of our planet and support the programs you care passionately about—not overhead or operating costs.

- Donor-advised fund (DAF) - By simply signing your name you can leave your DAF as a beneficiary of National Geographic which will allow us to invest every philanthropic dollar towards our Explorers and programs. Not only can you assign us as a beneficiary but a DAF is a charitable giving tool that helps you meet your philanthropic goals while enjoying tax benefits. Think of it as a charitable savings account, which allows you the flexibility to recommend how much and how often funds are granted to the National Geographic Society and other qualified charities of your choice.

- Cryptocurrency - As an asset that can appreciate rapidly, donating your cryptocurrency that’s been held longer than a year is a way to limit your capital gains tax while benefiting a cause you care about. Work with your third party wallet to leave the National Geographic Society as a beneficiary or leave us all or a portion of your wallet through your will or trust.

Use Your Required Minimum Distribution for Good

If you are 70.5 or older, you can transfer any amount up to $105,000 per year from your IRA directly to the National Geographic Society.

Funds remaining in retirement accounts after your lifetime are heavily taxed if left to someone other than a spouse. Many donors choose to use their IRA resources for charitable giving, while leaving other less tax-burdened assets to family and friends.

With an IRA charitable rollover you can see, during your lifetime, the impact of your gift to help us explore and protect the wonder of our world. See our handout.

Benefits

- Your gift helps satisfy your required minimum distribution.

- You avoid paying income tax on the distribution.

- You help reduce highly taxed assets.

- You receive tax benefits even if you don’t itemize your deductions.

- Gifts of $1,000-$24,999 automatically qualify you for our Grosvenor Council and you’ll receive exclusive, behind-the-scenes access to the Society.

- Gifts of $25,000 or more automatically qualify you for our leadership giving societies, which provide special access to the people, places, and work that make up the Society.

Frequently Asked Questions

How does an IRA charitable rollover benefit me? An IRA charitable rollover helps reduce your federal income tax by providing the opportunity to make a gift using your required minimum distribution.

Will my gift be taxed when taken out of my retirement account? Gifts from your IRA must be made payable to the National Geographic Society in order to qualify. An IRA Qualified Charitable Distribution is not subject to federal income taxes.

Can I use my rollover for a charitable gift annuity? Yes! IRA owners who are 70.5 or older may now make a one-time distribution for a CGA. There are some limitations to consider with this law so please contact our Planned Giving office to receive a personalized illustration and the maximum rate allowed per person. IRA charitable rollovers cannot be used to fund donor advised funds or private foundations.

Can I use an investment from a different retirement fund? A QCD can only be made from a Traditional or Roth IRA. Gifts from 401(k)s, 403(b)s, and other plans do not qualify.

Is there a limit to the amount that I can transfer? Yes. Federal law limits the annual contribution from an IRA to a charity, which increases annually with inflation. Please contact us and your advisor for current limits.

How to Make a Gift

- Contact the Planned Giving Office for a customized letter to your administrator.

- Contact your plan administrator and request a charitable IRA rollover to be distributed directly from your IRA to the National Geographic Society.

- Our address: 1145 17th Street NW, Washington, DC 20036.

- Our 501(c)(3) federal tax identification number is 53-0193519.

- Please make sure your name is on the gift transfer and you notify us of your gift intention so we can make sure your gift is received and recorded properly.

By donating all or part of your property to the National Geographic Society, you may be able to receive an income tax deduction and reduce your capital gains tax while supporting the Society’s vital work.

How It Works

- You deed or bequeath your property, such as a home, vacation home, commercial building or investment property, to the National Geographic Society.

- The National Geographic Society will sell the property and use the proceeds to support vital programs.

Benefits

- You receive an income tax deduction for the fair market value of the real estate.

- You may reduce or eliminate capital gains taxes owed on an asset.

- You have the potential to support our work with a larger gift than you could during your lifetime.

- You will create a lasting gift to help us support our Explorers who are dedicated to our mission to use the power of science, exploration, education, and storytelling to illuminate and protect the wonder of our world.

Together we can change the world.

Our Legacy team would be happy to provide you with more information about how to create a lasting and meaningful legacy, how you can further your financial and philanthropic goals, and answer any additional questions you may have.

Phone: (800) 226-4438

Email: legacy@ngs.org

National Geographic Society

Attn: Planned Giving

1145 17th Street NW

Washington, DC 20036-4688

The National Geographic Society is a 501(c)(3) nonprofit organization.

Our federal tax identification number is 53-0193519.

Already included the Society in your estate plans?

If so, let us know. We’d love to include you in our Alexander Graham Bell Legacy Society.

Need a will?

Alexander Graham Bell Legacy Society

Named after National Geographic’s second president, the Alexander Graham Bell Legacy Society honors those who have included the National Geographic Society in their estate plans through a will, trust, charitable gift annuity, or by beneficiary designation of a retirement plan such as an IRA or 401(k). Legacy gifts from the dedicated members of this group fund the Society’s exploration, research, and education efforts around the world.

If you have already included us in your estate plans or are interested in learning more, please contact us at 800-226-4438 or email legacy@ngs.org.

Benefits of membership include:

- Invitations to exclusive receptions, exhibitions, and lectures.

- Personalized membership certificate celebrating your dedication to the National Geographic Society.

- The Society’s gift-planning newsletter, Explore Tomorrow, which contains Society program updates, Explorer spotlights, Legacy member stories, and financial planning ideas.

- Recognition in the Society’s annual report, with the option to remain anonymous.

Photo credits from top of page: Peter Muller, Joel Sartore, ID Boyce